SMSF members certainly haven’t been immune to the impacts of COVID-19, with recent ATO statistics (August 2020) suggesting approximately 35,000 applications by members for the early release of super have been processed across nearly 19,000 funds, totalling nearly $341 million. Interestingly, within the first tranche, the ATO said that around 22,000 approved applications were made by just over 17,000 SMSFs for the release of nearly $215 million in total.

SMSF Annual Return

As trustees complete their fund’s annual compliance requirements, it is important to understand the reporting obligations on such amounts within the SMSF Annual Return.

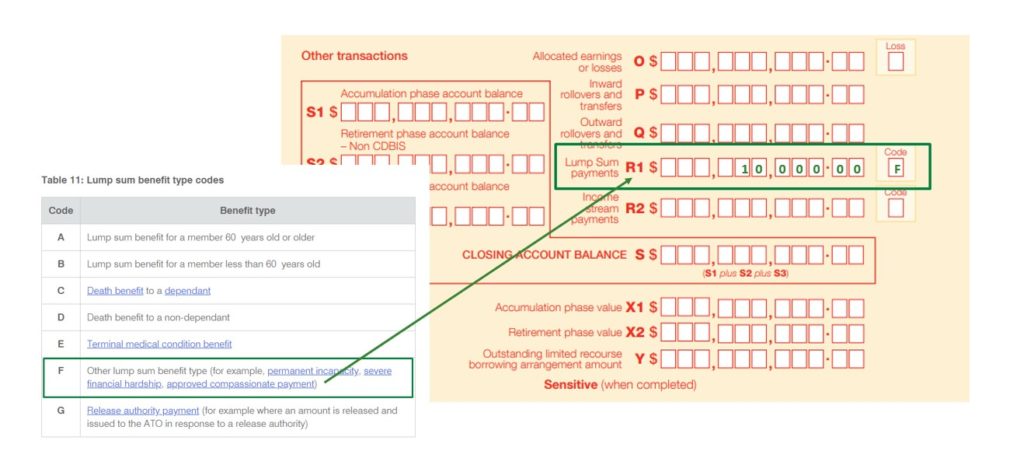

It would be fair to say that the use of the ‘compassionate ground’ condition of release has been rarely used across the profession, therefore it is important to understand how such amounts taken in the 2019-20 year need to be reported. The image below shows the early release amount due to COVID-19 is required to be reporting in ‘Section F: Member Information, Label R1 – Lump Sum Payments’. The code for this label is ‘F’, being other lump sum amounts including approved compassionate payments:

For further information, you can refer to the SMSF Annual Return 2020 instructions issued by the Australian Taxation Office.

Smarter SMSF also offers a variety of smsf documents including LRBA documents, smsf investment strategy templates and more. Browse our selection today.