Smarter document solutions to help within your SMSF business

SMARTER DOCS

In today’s SMSF landscape, there’s an ever-increasing focus on the need for compliant SMSF documents. This requires knowledge, time and capacity to build and maintain these within your SMSF business. At Smarter SMSF we provide the most comprehensive range of SMSF specialist legal, pension and compliance documents available in the marketplace today.

SOME OF OUR MOST COMMON DOCUMENTS INCLUDE

SMART & COMPLIANT

Our document solutions help you and your SMSF clients to stay compliant in an ever-changing legislative and regulatory environment, allowing you to focus on what you do best.

We believe that smart people stick together with Hill Legal and our member community, we continue to create and evolve our SMSF specialist document suite.

It’s our relationship with our members and being nimble and adaptive to change, that sets us and the quality of our SMSF documents apart from other service providers in the industry today.

LEGAL REVIEW

Smarter SMSF provides the ability to have a range of documents legally reviewed before client sign off.

The Smarter Legal Review (SLR) service is designed to help advisers risk mitigate legal issues that can arise with documents that are updated or created based upon an incomplete or defective trail of earlier created documents.

You can choose from two levels with the SLR service – scoped review or comprehensive review, giving you the piece of mind that the document created has had legal oversight.

The SLR service is provided by Smarter’s legal services provider, Hill Legal Lawyers, who provide specialist SMSF advice and who have contributed to the drafting and review of Smarter SMSF documents.

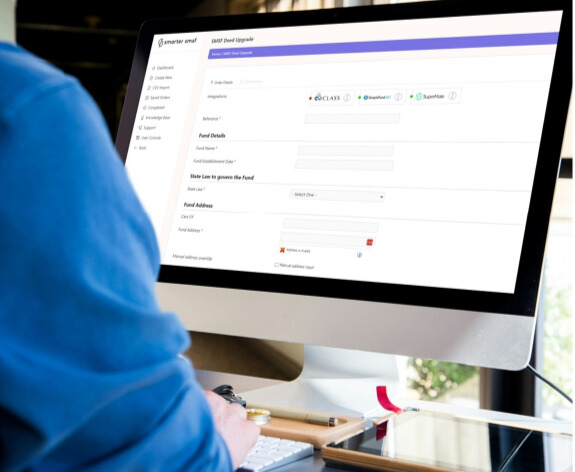

SMART INTEGRATIONS

Save valuable time with our key integrations with SMSF software providers, BGL, Class, & Supermate.

SOME OF OUR MOST COMMON DOCUMENTS INCLUDE

SMARTER PLATFORM FEATURES

DOCFLOWS

DEED SERVICE

CSV IMPORT

ORDERS CONSOLE

SMARTER SUBSCRIPTIONS

Order documents via a subscriptions, or simply pay as you go.