SMSF Foundations Course

SMSF Foundations Course

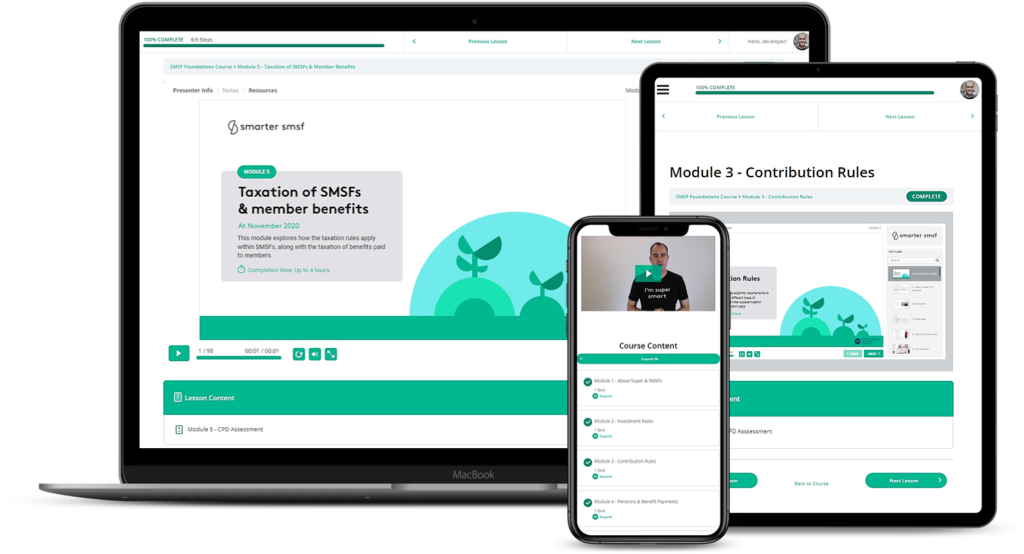

The SMSF Foundations Course has been built by two of Australia’s leading SMSF specialists, Aaron Dunn and Tim Miller. The course contains 6 modules, providing a total of 10 hours of e-learning based education. It introduces SMSFs and broader superannuation concepts to new entrants about the fundamentals in completing their day-to-day work.