The ATO has provided an update using Online services for agents that now allows viewing transfer balance cap information and to also lodge the Transfer balance account report (TBAR).

Lodging an electronic TBAR

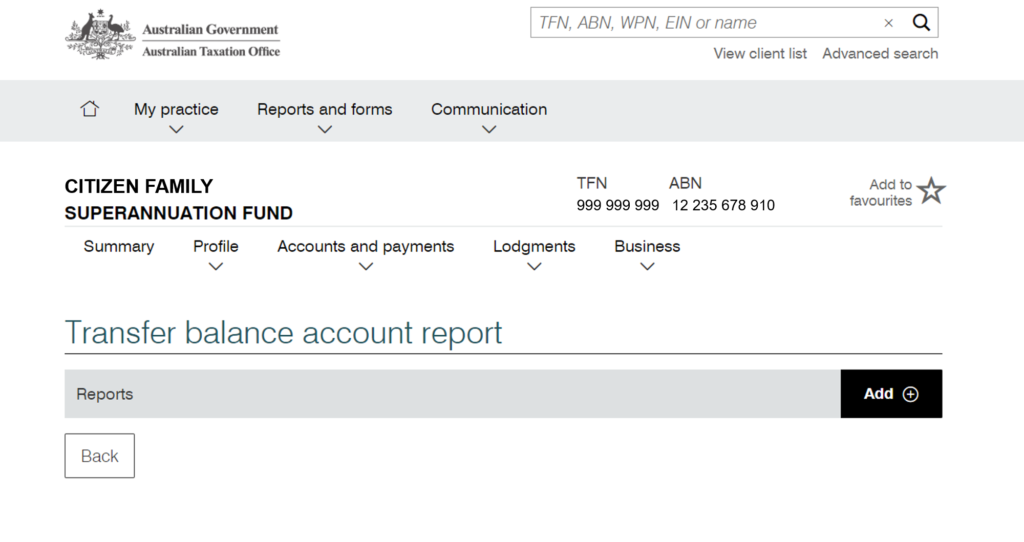

You can now lodge a transfer balance account report (TBAR) electronically by completing an interactive form in Online services for agents.

The electronic TBAR form is the preferred method to submitting this report. It will eventually replace the interim spreadsheet solution and has a number of advantages over the paper form, including:

- prefilling the supplier and provider details with your details and your SMSF client details

- prefilling the member details for second and subsequent events for the same member

- inbuilt verification rules to reduce reporting errors and reverse workflow

- events reported via the online form are generally processed by our system within 24 hours.

To lodge a TBAR in Online services for agents, select a client, then Lodgment, Client forms and Transfer balance account report.

Viewing transfer balance cap information

Using Online services for agents you can view more information about your individual client’s transfer balance cap. This includes:

- your client’s transfer balance and available cap space

- your client’s capped defined benefit balance

- all transactions we have processed and posted to your client’s transfer balance account

- information about an excess transfer balance determination

- information about a commutation authority

- any liability for excess transfer balance tax.

To view transfer balance cap information in Online services for agents, select your client then > Super > Information > Transfer balance cap. See the screenshot below from the (beta) tax agent portal:

A source of frustration?

Whilst tax agents can lodge the TBAR through the portal for each member in the SMSF that they administer, unfortunately once lodged this information for the individual can only be accessed where the member is also a client of the tax agent. This is a current source of frustration as it doesn’t not allow access for certain accountants, administrators and advisers to have an appropriate visual on each member’s transfer balance account to ensure they stay within the transfer balance cap (TBC). The ATO is aware of this issue and are exploring how they can look at options around the various privacy requirements in these circumstances.

For further information, visit the ATO website – https://www.ato.gov.au/Super/Sup/Online-TBAR-lodgment-and-TBC-information-now-available/.