Since the ATO issued letters to 17,700 trustees regarding issues with the diversification requirements, it has been interesting to observe the varying behaviours within the SMSF sector regarding this issue. For some, it has clearly been seen as an opportunity to go back and review the fund’s within their practice regarding the fund’s investment strategy documentation, for others, the view is that the ATO has made a mountain out of a molehill.

We have recently seen the ATO SMSF segment assistant commissioner, Dana Fleming, make comment that the need to address this updated requirement is not to recreate ‘war and peace’ (e.g. a new Statement of Advice), however sufficient evidence does require more than lip service to the requirements within SIS Regulation 4.09. In particular saying that ‘the trustees have considered the items in regulation 4.09B [of the SIS Act]’ is not sufficient.

Whilst the target of these letters was directed towards SMSFs within single asset concentration in property with LRBAs, it was also interesting to see the ATO make the comment that nearly one-third (180,000) of funds existed with 90% or more of their retirement savings in a single asset or asset class. Against the backdrop of two important case law decisions (Cam & Bear Pty Ltd v. McGoldrick and Ryan Wealth Holdings Pty Ltd v. Baumgartner) last year against SMSF auditors, I suspect that the SMSF audit fraternity will be far more diligent in being satisfied that the fund has adequately considered the requirements of the operating standard, SISR 4.09 – not just for the 17,700 that have received letters, but more generally for the 180,000 funds that reflect similar positions.

Why is this important?

For trustees, there is a need to understand that adhering to the requirements of the investment strategy process is not just about compliance, where failure can lead to administrative penalties of $4,200 applying (20 penalty units), but without having a properly formulated and clearly communicated investment strategy, the trustee is at risk of action being taken by a member (or beneficiary) under section 55 of the SIS Act for recovery loss or damage for contravention of a covenant within section 52B, applicable for SMSFs.

How to satisfy this requirement?

First and foremost, the fund’s investment strategy needs to be documented that clearly demonstrates that all elements of regulation 4.09B have been taken into account, including the personal circumstances of the fund.

Find out more about Smarter’s SMSF investment strategy template

What is also important is that where heavy asset concentration exists, the ATO has indicated that a simple trustee minute or some other kind of addendum to the investment strategy that acknowledges the decision to invest within a single asset, what type of asset it is and the rationale for long-term growth and it’s suitability to meet the member’s retirement objectives.

Poll

Tell us what you think? Is the ATO’s approach overblown? or do you think it’s a good thing where the industry can step up to improve the role of a fund’s investment strategy in meeting retirement objectives?

Time to step up?

The decision by the ATO to issue such a letter reflects a level of concern by the Regulator to trustee awareness of the role that an investment strategy plays in building for retirement. This initial letter (i.e. there may be more in the future) reflects an outcome that the ATO would be pleased about.

It has certainly heightened awareness of the topic and in many instances we are seeing many practices working with SMSF clients revisit the quality of documentation they have in place with their investment strategy. Some firms are taking the opportunity to address this documentation for all SMSF clients, for others, using this to address certain clients that have heavy asset concentration in meeting SISR 4.09. See our previous article, insights from our investment strategy webinar.

Smarter SMSF investment strategy

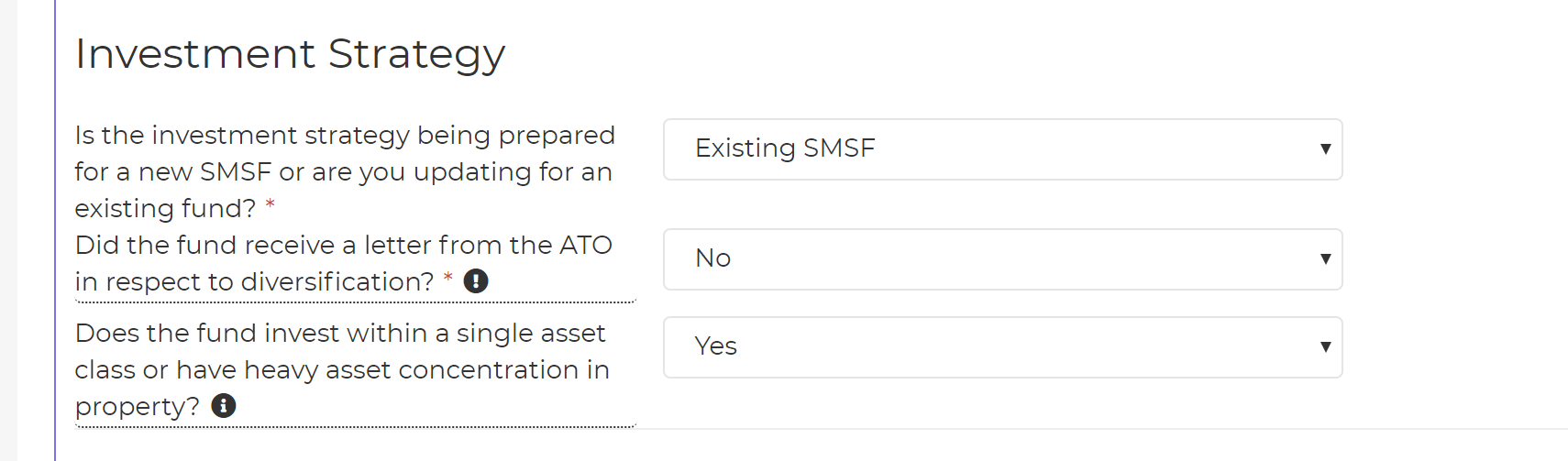

In addition to the investment strategy template that can be created on the Smarter SMSF platform, you now have the ability to produce additional trustee minutes in response to the ATO letter or alternatively where the fund has heavy asset concentration (currently property only, but expanding this to include various other asset classes).

SMSF Investment Strategy Order Form – based upon your responses it will generate additional trustee minute(s) that deal with the ATO letter on diversification, or alternatively where the fund has heavy asset concentration.

A reminder that we currently have the investment strategy document on special for $99 (incl. GST) until 31 October 2019.

We will shortly be releasing this document to create within Simple Fund 360, in addition to using existing integrations on the Smarter SMSF website. We also expect to be releasing in the near future a bulk investment strategy process, should you wish to generate multiple documents as part of a single order – using the fund information within your BGL or Class software.

The answer to the poll question is “both”. Everyone has mistaken the ATO’s approach and has overblown it. Every SMSF must have a properly formulated, and documents, investment strategy. There isn’t a “one fits all” type and the ATO is simply asking trustees to make an educated decision and document it. A fund may have all its investent in cash if that is what the trustees consider to be the most appropriate investment for the fund taking into account the number of members, their age, their risk tolerance and the fund status (pension or accumulation phase). No one can tell the trustees that this is wrong: the whole point is to make sure that trustees take theor role seriously. And it may very well be that thos 17000 funds have been swayed by the rogues and set up a fund, went the LRBA route etc. etc. This whole episode has been a HUGE over reaction by the participants.

I agree with George when he states that “Every SMSF must have a properly formulated, and documents, investment strategy”. The problem that I have found in my role as auditor is that very few actually have one. Since the ATO letters, we have been looking much closer at the strategies we are provided with and more that 80% have issues, in our opinion. I agree with the ATO that having an investment range between 0% and 100% in say 5 asset classes is a strategy. It is not formulated. Also every strategy may list the requirements of r.4.09, but that is not a property formulated strategy. Almost every fund has either a strategy that was drafted and signed when the fund was established, or one produced from the software template each year. The annual minutes may state that the strategy has been reviewed, but I doubt that is true in most cases. We are now looking for asset ranges that make sense (when included in the strategy) and where there is a high investment in a single asset class, for a reason why. That need not be complex. For an older member, it may simply say that cash is selected for asset protection, for those investing in listed securities it may be that the trustee believes they have diversification within the asset class. In most cases the trustees will already know why. They just need to document it.

I agree entirely Eric. Whilst the ATO acknowledge that they could have improved on the letter (e.g. not include penalties in the first para), the level of attention from this exercise to any area that is not done very well by trustees is a good outcome.