Investment strategies continue to remain a key focus area for the SMSF industry, in particular following the ATO’s updated guidance earlier in 2020.

We’ve had a growing number of requests from our members and PAYG users of the Smarter SMSF platform about the requests from auditors to provide further evidence of the diversification requirement where heavy asset concentration (or a single asset class) exists. Whilst the ATO initially focused their resources on real property with LRBAs, the application of meeting the diversification requirement set out in SISR 4.09 certainly extends across all asset classes as part of an SMSF investment strategy.

As a result, Smarter SMSF has now expanded its investment strategy documentation to now provide additional trustee minutes supporting asset concentration within the following areas:

- Real Property

- Real Property (within a Unit Trust)

- Australian Listed Shares

- International Listed Shares

- Fixed Interest

- Cash

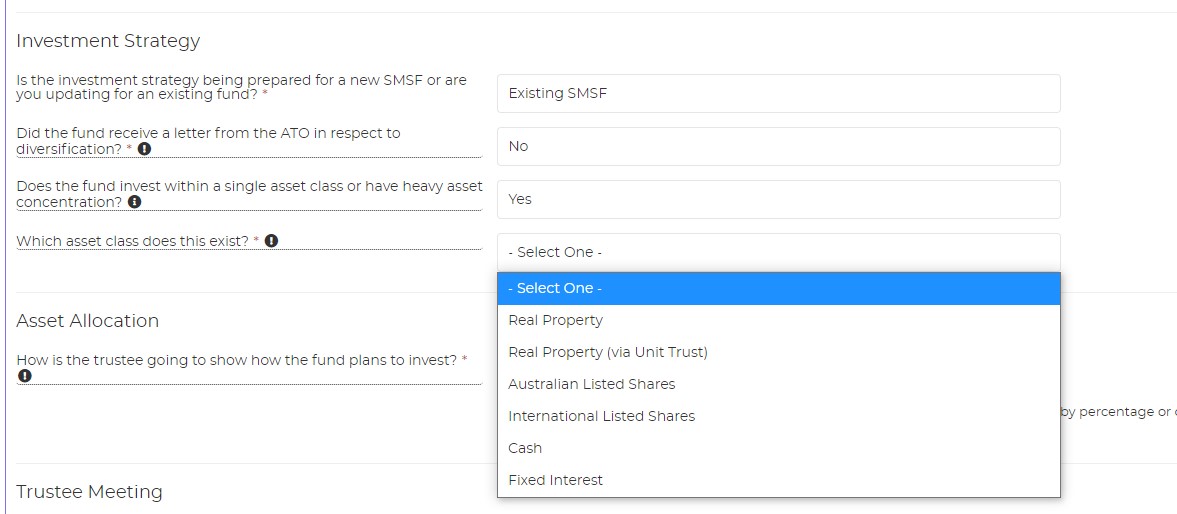

This change is now reflected on the order form where a ‘yes’ response to a fund investing within a single asset class or heavy asset concentration will now allow you to choose from a drop-menu to select the asset class:

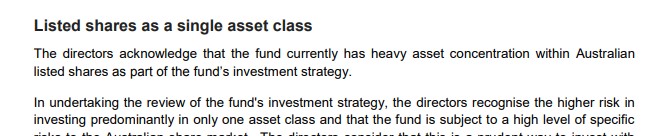

Once the order is generated, based upon the above selection, the appropriate trustee minutes are generated in addition to the investment strategy report – see a couple of extracts below for Australian listed shares and fixed interest:

Please note that this change is now reflected on both the Smarter SMSF platform and is available as part of the integrations within BGL and Class. Furthermore, these changes have also been reflected inside Simple Fund 360 where you can order a range of Smarter SMSF documents.

Visit our investment strategy report SMSF Investment Strategy Report page for further information about this document.