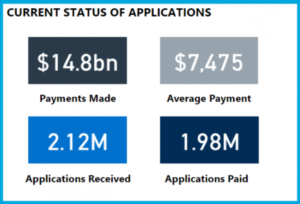

The ability for people impacted by COVID-19 to gain early access to super has seen nearly two million applications made to super funds for payment under the compassionate ground due to coronavirus, representing approximately 1 in every 6 Australians in the workforce.

Source: https://www.apra.gov.au/covid-19-early-release-scheme-issue-7

We’ve seen over this pandemic period, concerns with identity theft on people having their superannuation savings access illegally, along with ‘strategies’ being considered to obtain tax advantages through withdrawal and tax deductible contributions.

Whilst the Australian Federal Police (AFP) has been actively following illegal activity through identity theft, it appears the ATO is now ramping up its activity on individuals who may have made false and misleading declarations to gain access of up to $10,000 of their super illegally.

ATO integrity and compliance radar

The ATO have released a series of communications in the past few days to remind taxpayers of their obligations in making an accurate and honest assessment for eligibility. Designed to help through work through the impacts of the pandemic, the ATO is also making very clear that where people deliberately exploit the system, they will take action. It seems like a timely reminder as we move towards the second round of withdrawals be able to be applied for from 1 July 2020.

If the ATO finds that a person has applied for COVID-19 early release of super when they do not qualify, or mainly for the purpose of obtaining a tax benefit, (for example as part of a recontribution strategy involving the claiming of a personal super contribution deduction), they will consider taking further action.

The ATO have a range of data sources available that allow them to check for claims that were made incorrectly. This includes:

- Single Touch Payroll (STP)

- Income tax returns

- Information reported to the ATO by the member’s super fund

- third party data from agencies including:

- Services Australia

- Home Affairs.

For example, through STP the ATO have real time information as to whether people are employed and how much they are being paid. The Commissioner’s compliance approach is based on ensuring that people have not exploited the measure. Where the ATO have concerns that claims were not genuine they will review them.

Behaviours that will attract the ATO’s attention include:

- applying when there is no change to your regular salary and wage, or employment information

- artificially arranging your affairs to meet the eligibility criteria

- making false statements or fraudulent attempts to meet the eligibility criteria

- withdrawing and recontributing super for a tax advantage.

The ATO are investigating some cases and may consider it appropriate to apply the general anti-avoidance rule for income tax (known as Part IVA) in relation to a COVID-19 early release of super arrangement if the person (or a representative) enter into a scheme mainly for the purpose of obtaining a tax benefit.

The ATO have published a range of examples of their website that contemplate many of these scenarios.

Re-contribution strategy – don’t be like Matt…

One of the ideas that had been floating around was for individuals who qualified to access the early release super amount, but didn’t require this amount to still take the lump sum and then recontribute as a tax deductible personal super contribution under section 290-170 of the ITAA 1997.

This strategy can result in a range of tax outcomes, depending on the person’s own tax circumstances could also result in tax and superannuation implications including:

- Excess contributions tax – the person may need to pay additional tax if they exceed their concessional or non-concessional contributions cap;

- Contributions tax – concessional contributions made to the member’s super fund are taxed at the 15% rate by the fund potentially impacting any eligibility for a super co-contribution; and

- Division 293 tax – a person may need to pay additional tax due to their income and personal super contributions.

Part IVA: the general anti‑avoidance rule for income tax

The key area of focus here is the application of Part IVA, whereby the individual may have entered into a scheme mainly for the purpose of obtaining a tax benefit.

Schemes under COVID-19 early release of super that attract our attention include:

- artificially arranging your affairs to meet the eligibility criteria;

- withdrawing and re-contributing super to claim a tax deduction; and

- contributing an amount of super to claim a deduction and then withdrawing that amount.

Where Part IVA applies to a scheme, the tax benefit obtained may be cancelled. In addition, administrative penalties and interest charges can also apply.

The ATO provides the following example on how Part IVA may apply with this strategy:

Example: Withdrawing super to recontribute and gain a tax advantage

Jess, an airline pilot, is stood down by her employer when COVID-19 travel restrictions are put in place. Jess decides to apply for a COVID-19 early release of super mainly for the purpose of re-contributing the amount into her super fund in order to be entitled to personal super contribution tax deduction. Jess’ financial situation is such that she does not need any additional financial support throughout COVID-19. In May 2020 she applies for $10,000 in COVID-19 early release of super. When she receives the money, she re-contributes it into her super fund within a short period of time and notifies her fund that she intends to claim a personal super contribution tax deduction. In July 2020, Jess submits her income tax return claiming a $10,000 personal super contribution deduction which reduces her taxable income.

The ATO determine that Part IVA applies as Jess entered into a scheme mainly for the purpose of obtaining a tax benefit. The Commissioner issues Jess with a new notice of assessment reflecting the cancellation of the tax benefit and impose a penalty and interest charges.

It is therefore critical that a person ensures that you comply with the eligibility rules to access super early and the broader obligations under the taxation legislation. We understand that these are uncertain times and people’s circumstances change, so it is important that you keep records demonstrating your eligibility in case we need to see them.

You can read me about this information posted on the ATO website below:

- https://www.ato.gov.au/General/COVID-19/COVID-19-compliance-measures/

- https://www.ato.gov.au/Individuals/Super/In-detail/Withdrawing-and-using-your-super/COVID-19-Early-release-of-super—integrity-and-compliance/

- https://www.ato.gov.au/Individuals/Super/In-detail/Withdrawing-and-using-your-super/COVID-19-early-release-of-super/

COVID-19 page

Visit our COVID-19 page for more information about the various COVID-19 SMSF documents available on the Smarter SMSF platform. Some are free to order through to 30 June 2020.

Available through subscription or order as required on a pay-as-you-go (PAYG) basis.