Since the release of the ATO’s letter to 17,700 trustees regarding concerns of the diversification requirement within their fund’s investment strategy, we have seen a significant level of activity and discussion around this topic… and in many respects that a good thing. Let me explain why…

A view held by the Regulator is that some 30% of SMSF trustees are deficient in their knowledge and understanding of what an investment strategy is and what’s is function is in the context of running their SMSF. Clearly this percentage is at an unacceptable level and therefore the Australian Taxation Office (ATO) is taking steps towards improving this as an outcome. Overlaying this with the work being done around LRBAs via the Council of Financial Regulators (CFR), you can see why the ATO has taken this very deliberate step in writing to trustees warning them of their obligations to have adequately considered diversification or at least have documented reasons as to why a lack of diversification is appropriate in the fund’s circumstances (and each of its members).

Fixing the deficiency

This huge amount of interest from our previous blog posts on the topic certainly followed through to our recent SMSF investment strategy webinar, where over 400 people joined Aaron as he works through the impact of the ATO’s letter and to help understand where we can find key lessons in appropriately building an SMSF investment strategy. This included:

- The fund’s deed – ensuring the trustees are following the procedures and limitations set out within the fund’s governing rules.

- ATO communication – understanding the impact of ongoing guidance provided by the Regulator to support trustees and fund auditors.

- APRA Guidance SPG 530 – understand what lessons can be applied from RSE trustees within the SMSF context; and

- ASIC Reports – in particular, REP 575 which focuses on ‘improving the quality of advice and member experiences’ for SMSFs

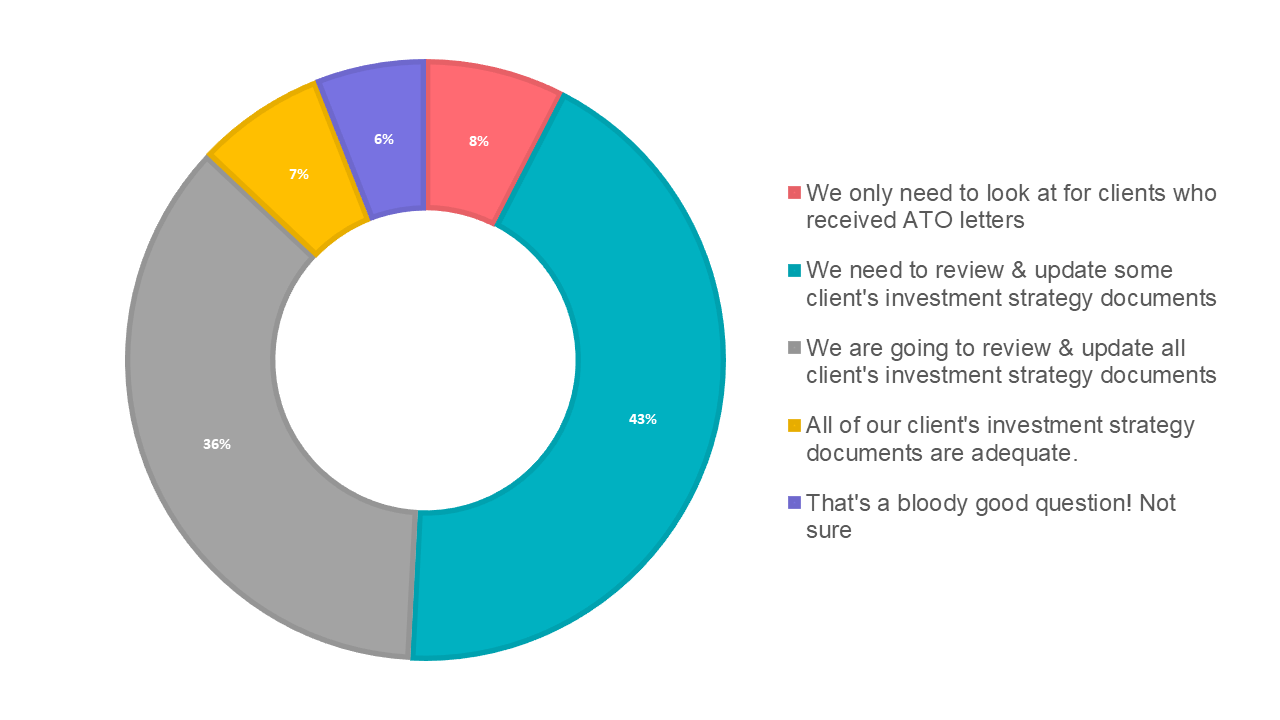

With such a great audience for the webinar, it was only appropriate to gain a further understanding of what action practices will look to undertake as a result of the ATO’s heightened activity in the area of SMSF investment strategies – the question was ‘which of the following best describes the action most likely to be taken by your firm with SMSF clients?’ The chart below the breakdown of the response…

Watch the webinar

You can watch the recording below to gain a better understanding of the key issues presented by Aaron in this SMSF investment strategies webinar:

Find out more about the SMSF investment strategy document provided by Smarter SMSF.

1 Comment