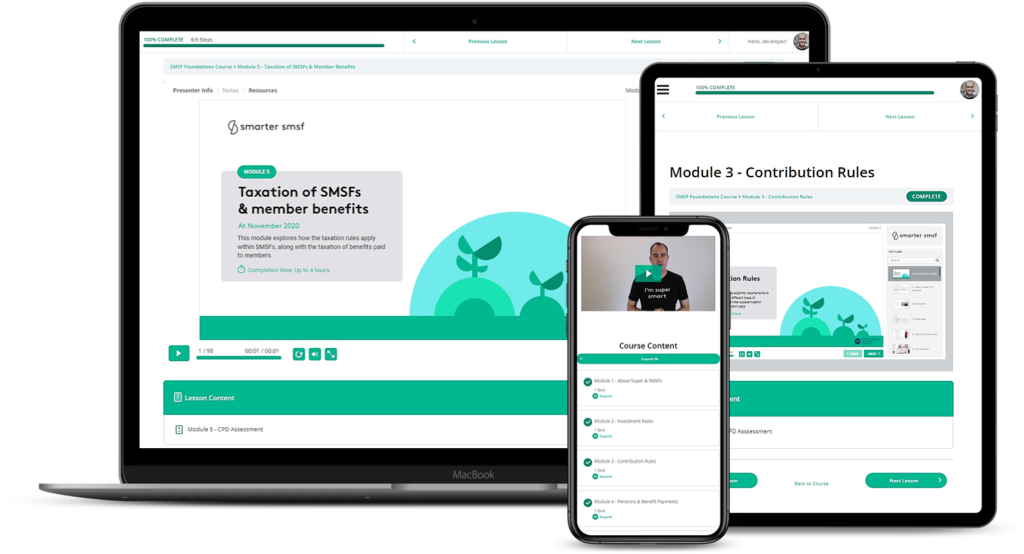

SMSF Essentials Course

SMSF Essentials Course

This 7 module accredited course built by SMSF specialist and CEO of Smarter SMSF, Aaron Dunn, provides 18 CPD hours and is designed to help professionals understand the core requirements of self-managed super funds.