The 2019 SMSF Annual Return (SAR) sees a few changes impacted by legislative reforms, along with the ability to capture further information for the Regulator about various fund investments. In this blog post, we explore what these changes are, the reasons behind them and what you need to know.

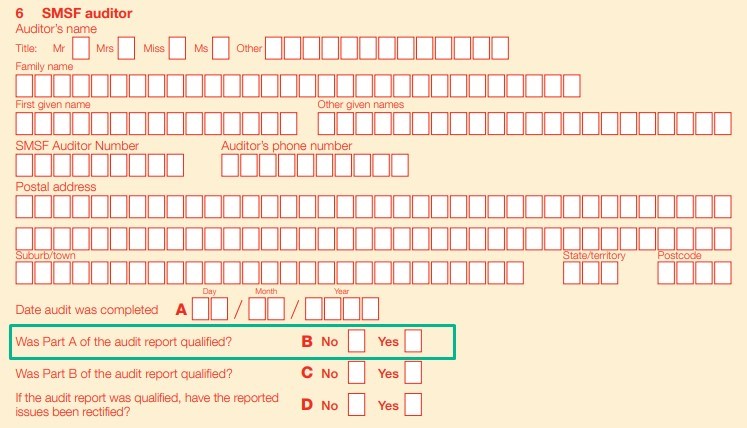

Part A Qualification

The biggest shift with the 2019 SAR is the Part A qualification that now must be reported to the Australian Taxation Office (ATO) – historically, this has never been the case, only requiring Part B qualifications to be reported.

Part A of the SMSF audit report focuses on the financial audit and requires the auditor to form an opinion as to whether the financial statements of the SMSF present fairly the financial position of the fund for that income year and the results of its operations. As a result, the auditor needs to be satisfied through obtaining evidence that support the assets and liabilities of the fund.

This can include correct ownership of fund assets, ensuring that fund assets are valued to their market value using the valuation guidelines provided by the ATO (or according to relevant accounting standards) and the application of any other accounting standards that may be relevant to determining the financial position of the fund.

Part A of the audit report appears to have become even more important since 1 July 2017 given the introduction of the transfer balance cap (TBC) for retirement phase and a member’s total superannuation balance (TSB), which impacts a variety of measures such as contributions and how a fund may be able to claim earnings tax exemption (ECPI).

Historically, qualifications to Part A of the audit have been used where the auditor cannot verify the existence of a fund asset without physical inspection (e.g. gold, collectible, etc), or alternatively where the fund may invest in certain assets, such as shares in unlisted companies unsecured loans or private unit trusts, where the value of recoverability cannot be determined without formally valuing the entity or having it audited. Some recent case law decisions, Cam & Bear Pty Ltd v. McGoldrick [2018] NSWCA 110 and Ryan Wealth Holdings Pty Ltd v. Baumgartner [2018] NSWSC 1502, highlighted the obligation of SMSF auditors to verify asset values in the financial statements.

See https://www.ato.gov.au/Super/Sup/The-SMSF-auditor-and-verifying-market-values-in-an-SMSF/

Cryptocurrency label

Where a fund holds crypto-currency, the ATO requires this information to be reported separately in the crypto-currency label within Section H – Assets & liabilities.

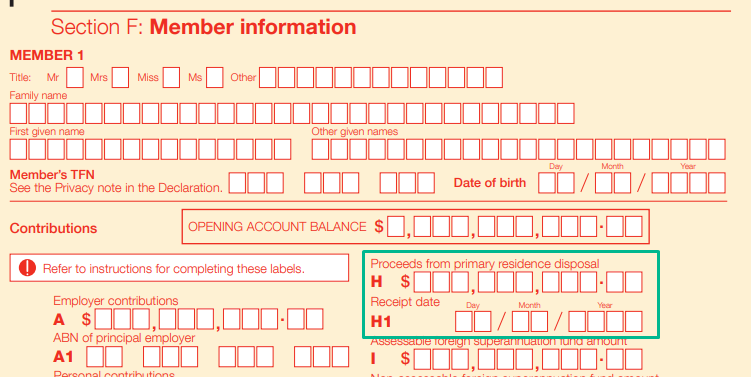

Downsizer contributions

From 1 July 2018, members who are aged 65 years old or older and meet all the eligibility requirements may choose to contribute up to $300,000 into superannuation from the sale proceeds of their home. To be eligible, the contract for sale must have been entered into on or after 1 July 2018.

Proceeds from a primary residence disposal (downsizer contribution) is a new contribution type and can only be accepted if allowed under the rules of the fund. If a member makes a downsizer contribution it is reported in the year it is made. The member will need to provide a Downsizer contribution into super form, either before or when they make their contribution. Downsizer contributions should be made within 90 days of the change of ownership of the dwelling (usually the date of settlement). An extension of time (EOT) may be granted where there is a delay, but an EOT will not be granted to allow the member to meet the age requirement.

Downsizer contributions can only be made on or after the member is 65 years old and can be made regardless of contributions caps and other restrictions (age and work test) that may apply when making voluntary contributions.

This information forms part of Section F, Member information and requires the contribution amount and date of receipt of the contribution by the fund.

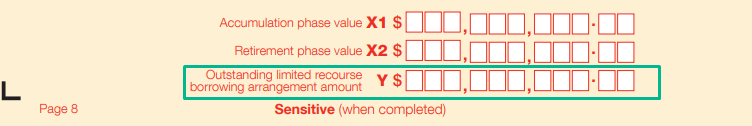

Outstanding LRBA amounts

A new label ‘Outstanding limited recourse borrowing arrangement amount’ has been added to Section F Member information and Section G Supplementary member to report outstanding limited recourse borrowings for each member.

This information was to assist the ATO in calculating a member’s total superannuation balance (TSB) for any new LRBAs that were entered into from 1 July 2018 – effectively adding any outstanding loan balance to determine a member’s TSB.

However, this proposed measure lapsed with Treasury Laws Amendment (2018 Superannuation Measures No. 1) Bill 2018 not being passed by both houses before the former Parliament dissolved. Therefore, at this time the data within label Y has no relevance for the completion of the SMSF Annual Return.

For more information about these changes to the SMSF Annual Return for 2019, you can review the instructions for completing the SMSF Annual Return on the ATO website.