In my previous article on dealing with the transfer balance account reporting (TBAR) requirements in respect to a reversionary pension, I thought it appropriate to explore this topic further in particular where the value of the income stream now exceeds the general transfer balance cap (TBC) of the surviving member.

Whilst the beneficiary has a 12-month deferral on the amount counting towards their transfer balance cap, it still does require the fund to report the starting value of the reversionary pension in line with the fund’s quarterly or annual TBAR requirements.

But before we continue, just to let you know:

You can create the following documents via the Smarter SMSF platform that relate to this article:

- Trust Deed Upgrade

- Pension Commencement

- Change of reversionary (‘add or remove’ reversionary beneficiary)

- Death Benefit Nomination

So, to understand further, let’s contemplate the following example:

Example

Tom (72) reported a pre-existing income stream, an Account-Based Pension (ABP) of $1,600,000 against his transfer balance cap at 30 June 2017. As part of recalibrating his superannuation interests inside his SMSF, Tom was also required to rollback $275,000 to his accumulation account. His wife, Denise was the nominated reversionary beneficiary of Tom’s ABP. She also had an ABP, with an amount reported against her Transfer Balance Account (TBA) at 30 June 2017 of $620,000.

At the time of Tom’s death on 1 November 2018, the value of his ABP has increased to $1,725,000.

What happens in respect to the reporting of the reversionary pension for transfer balance cap purposes?

The first issue that needs to be considered is the automatic entitlement for Denise to continue to receive the pension upon Tom’s death as the reversionary beneficiary. Guidance provided by the Australian Taxation Office (ATO) in TR 2013/5 – when a pension commences and ceases confirms that entitlement automatically continues upon death of the member. As a result, where the pension simply states Denise as the reversionary beneficiary, it assume a 100% reversion of the pension and therefore requires the fund to report the ‘credit’ event as follows:

Transfer Balance Account – Denise

| Date | Event Details | DR | CR | Balance |

| 30 June 2017 | ABP | $620,000 | $620,000 CR | |

| 1 November 2019 | Reversionary Pension | $1,725,000 | $2,345,000 CR* |

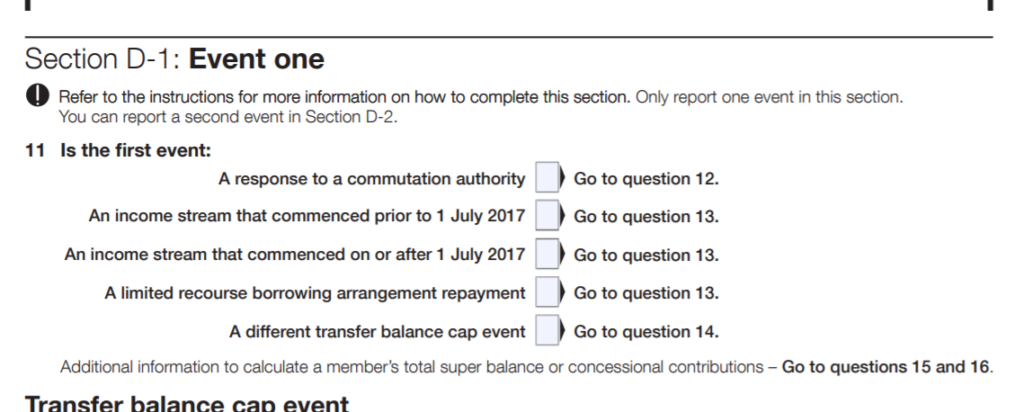

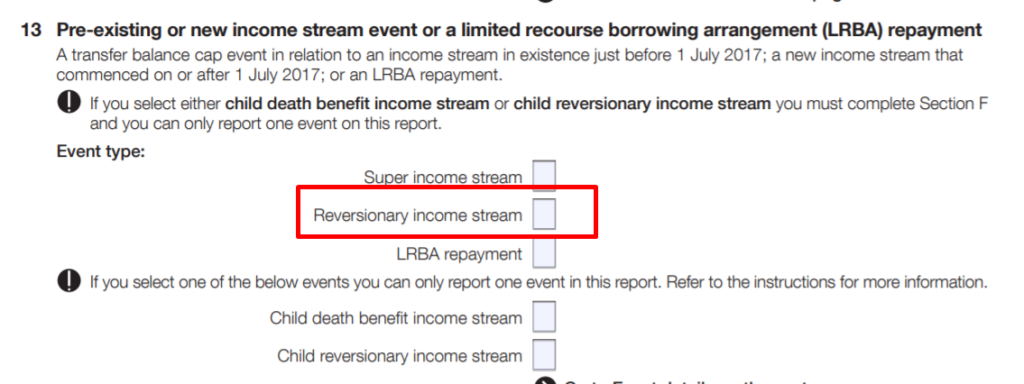

I have included an extract from the Transfer Balance Account Report (TBAR) that shows the labels to be completed:

Impact of TBAR lodgement

Having lodged the TBAR with the ATO for the ‘event’ of the reversionary pension, this will effectively forward date the crediting of the amount for 12 months (from date of death) to allow for Denise to make any necessary changes to comply with her transfer balance cap. Failure to take action within this timeframe will result in an excess transfer balance and an ETB determination being issued by the Commissioner to comply, in addition to having to include a notional earnings amount credited that must also form part of the commutation.

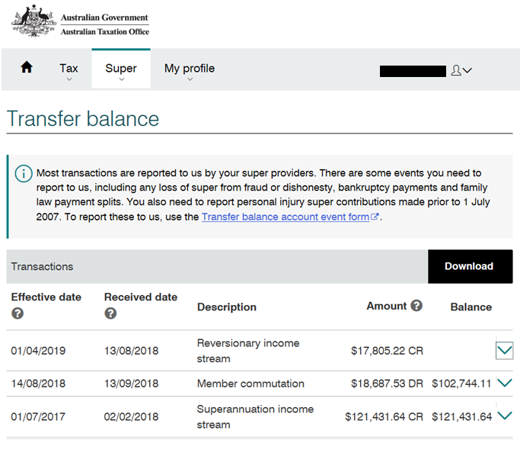

The following is an extract of how an individual’s deferred reversionary credit will apply on their transfer balance account:

Within this 12 month deferred credit timeframe, Denise will need to consider the following decisions:

- Rolling back part or all of her account-based pension to accumulation phase (to create available cap space); and

- Commute part of the reversionary pension which will require any surplus amount above the transfer balance cap to be paid as a lump sum death benefit from the superannuation system.

These actions will need to occur by no later than 1 November 2019, where the crediting of the reversionary pension will apply. Whilst technically these commutation actions would allow for reporting to be completed right up to 31 October 2019, the due date of 28 January 2019 to lodge the TBARs will cause practical problems with an excess transfer balance (ETB) determination likely to be issued by the ATO. Therefore, it may be more prudent to lodge by 28 October with the relevant actions having occurred at say 30 September (still within the 12 months).

As an example, the following is an outcome that may result in Denise complying with her TBC within the 12 month timeframe:

| Date | Event Details | DR | CR | Balance |

| 30 June 2017 | ABP | $620,000 | $620,000 CR | |

| 30 September | Commutation value of ABP | $700,000** | ($80,000) DR | |

| 30 September | Commutation of Reversionary Pension | $45,000*** | ($125,000) DR | |

| 1 November 2019 | Reversionary Pension | $1,725,000 | $1,600,000 CR |

** Value of existing ABP for Denise at the time of commutation, which for this example I have assumed is $700k – can be rolled back to accumulation or withdrawn from super system

*** This commutation must be cashed as a lump sum from the super system.

Can we change the level of reversion?

A potential solution with your existing pension members is to alter the level of reversion an existing income stream. By default, most SMSF pensions that are reversionary have a 100% reversion. This is because no indication has been made within the documentation to state something else – e.g. I wish to nominate my spouse, [spouse name] as the reversionary beneficiary of this superannuation income stream, which implies the pension is to fully revert (100%).

However, subject to the level of flexibility or control that may be required by the member, have scope to alter the level of reversion by percentage, amount or even up to the beneficiary’s transfer balance cap.

Let’s look at the same example, however the decision has been made to alter the level of reversion to an extent that Denise does not exceed her TBC:

| Date | Event Details | DR | CR | Balance |

| 30 June 2017 | ABP | $620,000 | $620,000 CR | |

| 30 September | Commutation of ABP | $620,000** | $0 | |

| 1 November 2019 | Reversionary Pension | $1,600,000 | $1,600,000 CR |

** the value of Denise’s ABP is now $700k and does not require her to commute the entire amount, only an amount the would bring her TBA back to $0.

As you can see in the above, the change in reversion would result in the value of the credit at 1 November 2019 being $1,600,000 and not require any commutation action from the reverted income stream. The difference in these two scenarios is that the withdrawal out of super as a death benefit lump sum is greater in this second scenario as we have aligned the reversionary pension to the surviving member’s TBC ($125k vs. $45k).

Why do the second rather than the first option?

The requirements outlined within TR 2013/5 outline that a reversionary pension is to include the name of the reversionary and relationship to the primary pensioner (also see para 17, LCR 2017/3). It also allows for the income stream to include a level of reversion – this may be in percentage terms or dollar amount. The importance characteristic is that if the trustee has the power or discretion to determine to whom the death benefit is to be paid, the form or the amount of the death benefit, then it is not allowed to automatically continue (as reversionary). Considering this guidance, it is arguable to extend this level of reversion concept to include such amount that would not result in the beneficiary to exceed their transfer balance cap, so long as the other requirements are met. The importance of the fund’s trust deed and pension documents are of course, fundamental to the implementation of such an arrangement.

Importantly, providing this option can be important for a member to be able to control the amount of the reversion, not just for transfer balance cap purposes, but also for estate planning purposes. This can be critical in the context of a blended family, where the member may want to split up their reversionary pension between their current spouse and say children from a former relationship. For example, the member may want to ‘auto-revert’ the pension to the spouse to their TBC as at the date of death, with the excess to be paid to their estate or otherwise dealt with as part of a BDBN. At ‘date of death’ is an important concept here, as it can limit any impact of commutations by the spouse of their existing income stream(s) to absorb a greater amount of cap space. Alternatively, consideration could be given to a member’s Total Superannuation Balance (TSB) as the measure, rather than the TBC – i.e. limit the reversion to an amount that would increase the member’s TSB to not exceed the general transfer balance cap at date of death.

Documenting the process

These new challenges now provide some interesting considerations when looking at the documentation surrounding pensions and structuring of the level of reversion with current and new income streams. As indicated, TR 2013/5 & LCR 2017/3 confirms that in addition to the nomination of a reversionary, the member can give consideration to the level of reversion. We are currently making changes to our existing pension commencement documentation on the Smarter platform that allows for members (and those who wish to order) to determine the level of reversion, which will include the following:

- 100% reversion;

- A level of reversion (%) nominated by the pension member;

- A level of reversion ($) nominated by the pension member;

- A level of reversion to the extent that the income stream does not put the beneficiary into an excess transfer balance position at the date of death (i.e. up to the beneficiary’s personal transfer balance cap).

The outcome of these above scenarios (except for the 100% reversion) is that upon death, it creates an auto-trigger partial commutation due to the level of reversion. In addition to the reporting for TBAR purposes, it will require the trustee to deal with this part of the super death benefit ‘as soon as practicable’ in accordance with SISR 6.21.

Importantly, within the Smarter SMSF pension documentation, the details of the income stream, including the reversionary considerations can become a special rule of the fund and a paramount document – effectively meaning that no other document (unless subsequently stated as a paramount document to supersede the pension) to override any other documents that may provide for a contrary position in dealing with the death benefit.

What about existing pensions? Can we adjust the level of reversion without ceasing the income stream?

It depends… where a pension is created under the Smarter SMSF deed, Rule 1.4 allows for the income stream to become a Special Rule of the fund. What this Rule supports is that where agreed to by the trustee and member, various conditions of the pension can be varied ‘mid-stream’ without requiring commutation and re-purchase of the income stream. This may be particularly important in the context of Centrelink and the grandfathering rules for pre-1 January 2015 pensions.

As a result of adding these additional reversionary options, we are also making changes to our existing ‘add or remove reversionary beneficiary’ document to allow for the reversionary options stated above. We will also rename this form to ‘change of reversionary beneficiary’, allowing for the ability to not only add or remove a tax dependant beneficiary, but to now also alter the level of reversion where the reversionary may already exist – for example where it currently represents a 100% reversion to a lesser percentage (%) or dollar amount ($) or to limit the reversion based upon the reversionary’s TBC.

The importance of having a valid DBN in place

Where a beneficiary needs to take steps in order to comply with their transfer balance cap, this does critically raise the importance of considering how an accumulation account needs to be dealt with in the event of death. This may mean preparing a valid binding death benefit nomination (BDBN) that provides appropriate instructions as to how to deal with the accumulation interest of the deceased member. Using the example above with Tom, where the level of reversion was less than 100%, the commuted amount would rollback to Tom’s existing accumulation account and therefore the payment of the death benefit lump sum would either follow any binding instructions left within a BDBN, or alternatively would be left to the discretion of the remaining trustee(s) / director(s).

Available documents

You can create the following documents via the Smarter SMSF platform that relate to this article:

- Trust Deed Upgrade

- Pension Commencement

- Change of reversionary (‘add or remove’ reversionary beneficiary)

- Death Benefit Nomination

3 Comments