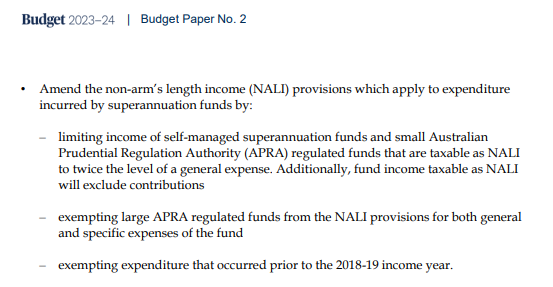

It appears within the Federal Budget that the Government has finally landed on how they intend to amend the non-arm’s length income (NALI) rules within s.295-550 of the ITAA 1997 to deal with non-arm’s length expenditure (NALE) that relate to general expenses of a fund.

Below is an extract from the budget papers on the Government’s formal position:

Earlier this year (January 2023), the Government released a consultation, a proposal to apply a factor-based approach for SMSFs to deal with the severely disproportionate approach that could arise under the Commissioner’s current views expressed in LCR 2021/2.

Is it a win?

In somewhat of a ‘win’ for the SMSF sector, we’ve seen the previous 5 times factor from the initial consultation, reduced to a now 2 times factor within the budget papers. Furthermore, contributions have been excluded from the NALI calculation. The result of this is that it sets an upper limit on the amount of fund income taxable as NALI due to a general expenses breach. The maximum amount of fund income taxable at the highest marginal rate is to now be 2 times the level of the general expenditure breach (or 90%, being 2 x 45%).

Treasury has confirmed that post budget that the same approach referred to in the consultation paper will apply at this reduced factor level.

Therefore, for the purposes of this post, taking details from the consultation, we can assume that the non-arm’s length expense (shortfall) is calculated as the difference between:

- the amount that would have been charged as an arm’s length expense; and

- the amount that was actually charged to the fund.

The consultation paper originally noted that where the product of factor-based approach breach is greater than all fund income, then all of the fund’s income will be taxed at the highest marginal rate.

To understand this further, let’s explore the following examples:

Example 1A: SMSF using an accounting service

An SMSF uses his brother’s accountancy service, which would usually cost $5,000 if provided under an arm’s length arrangement. As his brother charges the SMSF $0 for these services, this is a non-arm’s length arrangement.

The SMSF’s income (after relevant expenses) in the 2023-24 financial year is $100,000, ordinarily subject to a 15% applicable tax rate. The income includes concessional contributions of $15,000.

Under the current NALI rules, there is a sufficient nexus between the accounting services expense and all of the fund’s income. The total income in the financial year would be taxed as NALI, at the highest MTR of 45%, or $45,000.

Under the potential amendments, the income ‘tainted’ as NALI would be limited by the market value of the accounting service, since no fee was charged to the fund. The amount of income would be calculated by applying a factor of 2 on the difference between the:

-

- market value of accounting service; and

- Actual fee charged.

The trustee would pay tax at a rate of 45% on $10,000, and a 15% tax rate on the remaining $90,000 of income, resulting in $18,000 in tax (after-tax income of $82,000).

By comparison, under an arm’s length arrangement (ie. fund paid $5k for the accounting services), the SMSF would pay $14,250 in tax ($95,000 taxable income x 15%).

Example 1B: SMSF using an accounting service (lower fund income)

As in Example 1A, the SMSF trustee uses his brother’s accountancy service that would usually cost $5,000, but charges $0. The SMSF’s income (after relevant expenses) for the 2023-24 financial year is $20,000. Under the proposed amendments, the trustee would pay tax at a rate of 45% on all fund income, excluding contributions, as 2 times the NALE breach is greater than the total income of the fund.

To work this out, the comparison is the lessor of:

-

- $5,000 x (2 x 45%) = $4,500 in tax; or

- $5,000^ x 45% = $2,250 in tax

^ ($20,000 – $15,000 CCs) =$5,000 income

The SMSF would pay $4,500 in tax, being contributions tax of $2,250 ($15k x 15%) + tax on NALI of $2,250 for the 2023-24 financial year.

Cessation of ATO’s existing guidance relief

If these changes now proceed, it is important to note that the current PCG 2020/5 will cease as of 30 June 2023, meaning that any existing non-commercial arrangements in place will need to comply with commercial terms – see LCR 2021/2 for more details. The ATO has already indicated that they do not intend to extend the practical compliance guidance beyond the end of this financial year.

Our thoughts…

It is somewhat staggering that after 5+ years of trying to resolve these measures, the proposed outcome has resulted in an unlevel playing field between APRA funds & SMSFs, and that all of the proposed approaches from within a unified voice on this topic appears to have fallen on deaf ears. The decision by Treasury to apply to SMSFs is that they have the potential for greater tax integrity risks, due to the capacity to control or influence the general expense arrangement – potentially leading to an inflation of their super balance through a non-arm’s length arrangement. These would include amongst other things, circumventing the contribution caps and Division 293 threshold.

In reality, the question that needs to be asked is whether these measures are trying to solve a problem that no longer exists? It is worth noting that the genesis of this issue arose with the concept of zero interest related party loans for LRBAs.. This matter was however quickly ‘put to bed’ through the introduction of the safe-harbour provisions within PCG 2016/5 as part of applying the NALI provisions. Furthermore, through the SIS and tax laws, there are a number of mechanisms that can successfully deal with these matters, without the need to create these convoluted NALI calculations – e.g. TR 2010/1 that deals with contributions, or alternatively, introduces SMSF specific measures into the arm’s length rules within s.109 of the SIS Act, allowing auditors to form an opinion on its compliance as part of the audit process.

Unfortunately, like many things throughout the years of consultation, they appear to have fallen on deaf ears.