As outlined in our previous blog post, Treasury has finally released for consultation an exposure draft that proposes to effect two changes in respect to the exempt current pension income (ECPI) rules for the 2021-22 financial year:

- Removing the current unnecessary requirement to obtain an actuarial certificate to determine ECPI where 100% of the fund’s assets are supporting the payment of pensions, but the operation of s.295-387 of the ITAA 1997 applies (i.e. disregarded small fund assets); and

- Providing the trustee with a ‘choice’ in calculating ECPI where the fund has both segregated and unsegregated periods during an income year.

Initially announced in the 2018-19 Federal Budget, the start date of these measures were extended to 1 July 2021. In this blog post, I discuss the second measure of providing the trustee with a ‘choice’ in calculation tax exemption where the fund has both segregated and unsegregated pension assets throughout the income year.

It is important to note that the ‘choice’ of method only occurs in the context where the fund has periods of both the fund being in entirely in pension phase (i.e. deemed segregated period) AND has a proportion of both accumulation and pension assets – where an actuary certificate is required to determine tax exemption.

To understand this further, let’s consider the following example:

Example – ECPI choice available

Doug and Fran are members of their SMSF. Fran is retired and drawing an account based pension (ABP). Doug starts his ABP in the fund from 1 September 2021.

On 1 March 2022, Doug rolls back his pension to the accumulation phase and makes a NCC into the fund. He then re-starts his pension on 1 April 2022 and remains in the retirement phase until the end of the financial year.

As a result of these measures (to be finalised), the fund will have a choice at the time of completing the SMSF Annual Return to determine how the fund’s tax exemption (ECPI) will apply.

Making the choice

The explanatory memorandum to the exposure draft provides that the trustees will have the choice to determine the ECPI method at the time of the SMSF Annual Return – that is, it is an end of year function and not a decision that needs to be made anytime prior to the tax return.

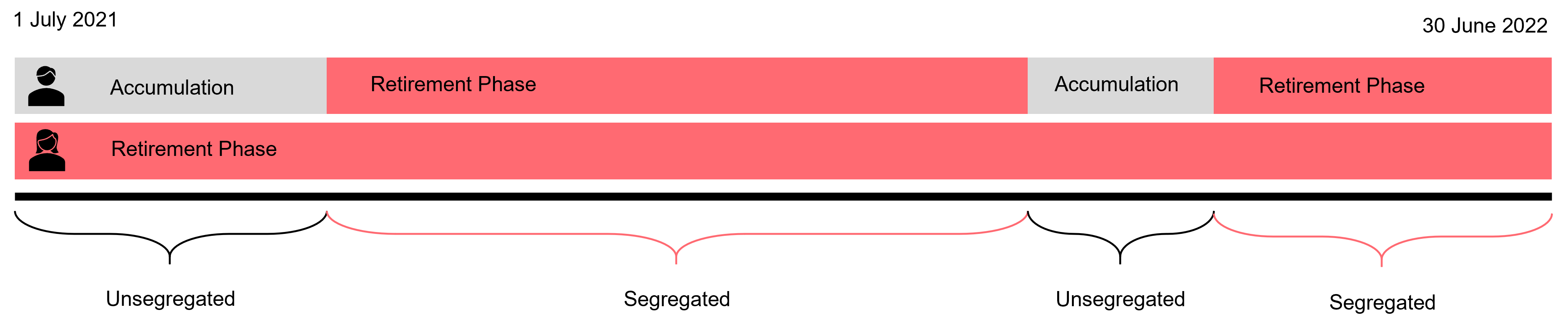

The diagram below shows you how the current method for determining ECPI occurs:

The important points to note are:

- All income and expenses received within the segregated periods are ignored for income tax purposes (s.295-385 and s.118-320 of the ITAA 1997);

- All income and expenses received within the unsegregated periods will have the tax exempt percentage applied from the actuary certificate as per s.290-390, ITAA 1997, and s.102-5 for CGT purposes.

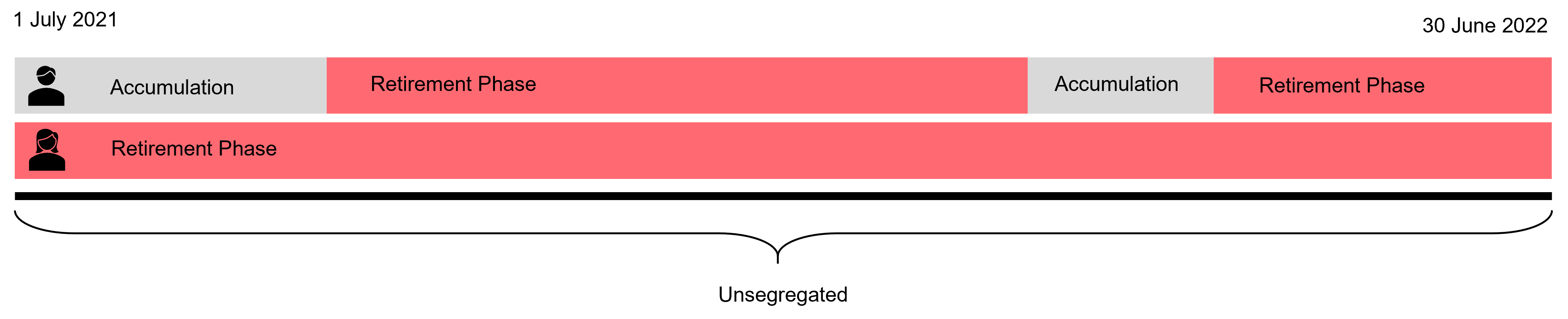

The alternate approach, takes us back to the ‘old method’ for determining ECPI – that is, rather than considering the timing of when income is received, the actuary certificate will apply for the entire income year and therefore consider what has been ‘earned’:

Based upon this ‘choice’:

- All income and expenses receive, regardless of the different periods will have the actuarial percentage applied to all income and expenses of the fund earned across the income year (s.295-390, ITAA 1997).

Different outcomes

Whilst this ‘choice’ will be limited to funds with both segregated and unsegregated periods during an income year, it is important to note that strategically there are some very different scenarios that can play out subject to the timing of income received, in particular with capital gains and losses.

Going back to our example with Doug and Fran, let’s assume that they sell an asset on 30 May 2022, where during this period the fund’s assets are entirely supporting pensions. By applying the current method of ECPI, any capital gains or losses are ignored, therefore providing a better result for a capital gain, than a proportionate tax exemption under the actuary certificate option (where the tax exempt % will be < 100%).

Alternatively though, it the asset crystallised a capital loss, it may be more prudent to consider the second option should the fund wish to carry forward to loss against future capital gains, as the calculation of any CGT is utilised under the method statement calculation in s.102-5 of the ITAA 1997.

Just these example above alone demonstrate the potential opportunities that will be available to consider when completing the tax return for 2021-22 and onwards.

I think it would not be unreasonable to think that the fund’s actuary will play an important role in helping to assess these situations to provide an optimal tax outcome. Trustees will also need to demonstrate through documentation that ‘choice’ that has been made each year in determining a fund’s tax exemption.

1 Comment