The Australian Taxation Office (ATO) has now registered SPR 2020/2 which applies to the trustee(s) of a SMSF where the fund acquires an in-house asset from a deferral of rental income under a lease due to COVID-19. This determination became effective from 27 November 2020.

As a result of the financial impacts of COVID-19, some self-managed super fund (SMSF) trustees have needed to provide rental relief in the form of deferrals to a related party tenant. Some SMSFs have also invested in regulation 13.22B and 13.22C entities who have also needed to provide rental deferrals to tenants.

Since a rental deferral amounts to a loan under the super laws, this can cause the SMSF to acquire and hold an in-house asset. Generally, this would mean the fund would need to dispose of the in-house asset before the next financial year where it exceeds the 5% threshold.

However, this SPR 2020/2 states for the purposes of paragraph 71(1)(f) of the Superannuation Industry (Supervision) Act 1993 (SISA), the resulting asset is not an in-house asset of the fund for the 2019–20 and/or 2020–21 years being the year or years of the relevant rental income deferral nor any future financial years, where during one or both of the 2019–20 or 2020–21 financial years the fund:

- allows a related party tenant a deferral of rental income under a lease (on arm’s-length terms) due to the financial impacts of the coronavirus known as COVID-19

- holds an interest in a related party which is exempt from being an in-house asset due to the operation of regulation 13.22B or regulation 13.22C of the SISR 1994, and that related party allows a tenant a deferral of rental income under a lease (on arm’s-length terms) due to the financial impacts of the coronavirus known as COVID-19.

The determination does not apply to rental waivers or reductions as this type of relief does not give rise to an in-house asset in the fund. However, it should be noted that the ATO has previously said that they won’t be taking any compliance action for the 2019–20 and 2020–21 financial years if an SMSF gives a tenant, even one who is also a related party, a temporary rent reduction or waiver because of the financial effects of COVID-19 during this period.

To understand this further, let’s consider the following example:

Example

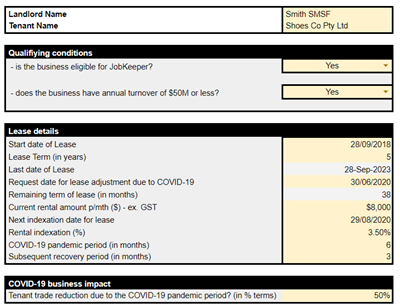

Smith SMSF is the landlord for a related party tenant, Shoes Co Pty Ltd. The tenant is an SME tenant that qualifies for rental relief to be applied in accordance with the Mandatory Code of Conduct (MCoC) for commercial tenancies.

The table below sets out details of the existing lease, including details of a business impact on turnover due to COVID-19:

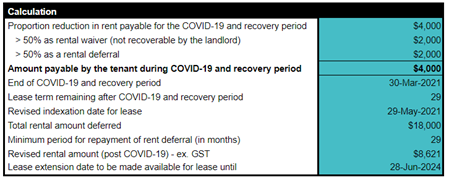

Following the MCoC, the tenant is granted a rental deferred for the pandemic and recovery period of $18,000, which is to be paid over the remaining term of the loan (or 24 months, whichever is greater).

For the purposes of the legislative instrument, the rental deferral of $18,000 is excluded from the IHA rules for 2019-20 & 2020-21 years.

Furthermore, it should be noted that there is no requirement for repayment of the rental deferral before 30 June 2021 – the tenant will continue to follow the terms agreed to with the landlord (SMSF) in line with the MCoC or otherwise negotiated as arm’s length terms.

Need more information?

Smarter SMSF offers a range of COVID-19 documents to support funds that have been impacted during the Government’s economic response to the coronavirus. You can visit our COVID-19 page for more information.