Treasury has recently released for consultation a range of miscellaneous amendments that include a a significant shift in the reporting obligations for SMSFs. To say this has come from left field would be an understatement.

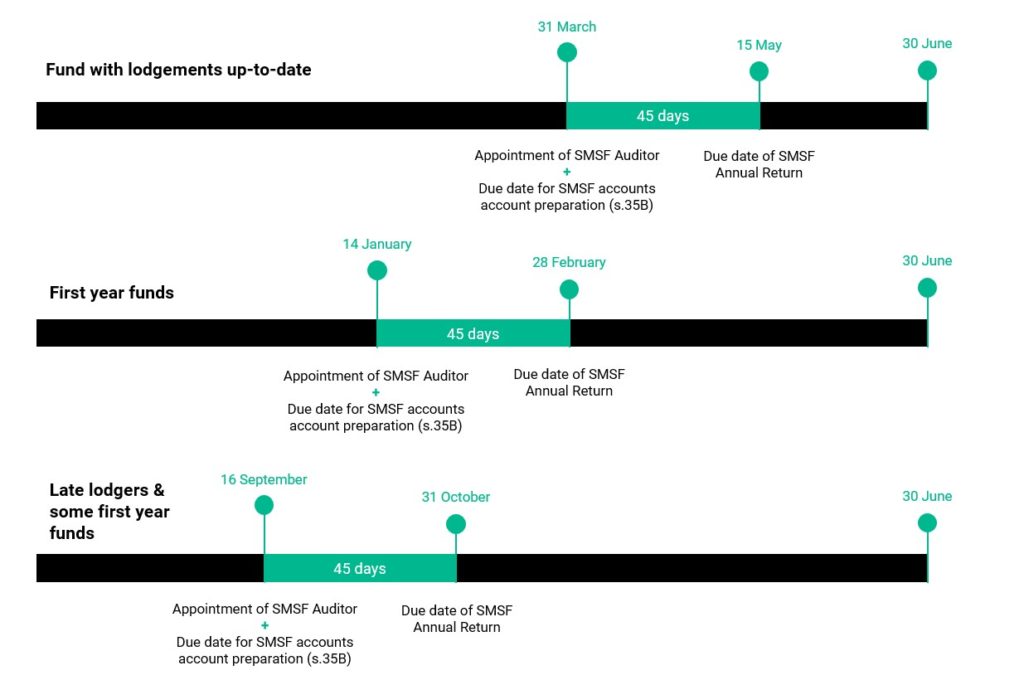

The proposed new measure will insert Regulation 8.02AA that will require the accounts and statements of an SMSF to be prepared at least 45 days before the day in which section 35D of the SIS Act requires the annual return to be lodged for the fund. This is the same day by which an approved SMSF auditor must be appointed under subsection 35C(1) of the SIS Act.

The application of the amending regulations will apply in relation to the accounts and statements for all funds.

Lodgement dates

These proposed changes would align the finalisation date of the financial statements with the final date that an SMSF auditor can be appointed for a income year by the fund trustees.

With different lodgement dates that apply for SMSFs, this 45 day period could mean in some instances that some financial statements would need to be finalised by 16 September, less than 3 months after the end of the financial year. Some funds would necessarily have all the fund information available to complete their financials by this stage, potentially awaiting tax statements or details of distributions from other trusts (related or not).

The diagram below outlines the different lodgement dates and time frames that SMSFs would need to comply with:

Such a decision to impose this measure could arguably lead to trustees ‘back-dating’ the signing of financials to ensure compliance, something that doesn’t serve the trustee or regulator any type of satisfactory outcome.

Failure to comply

An administrative penalty of 10 penalty units apply to a breach of the requirements in section 35B of the SIS Act. This could mean a penalty of $2,220 each for individual trustees, or $2,220 for directors of a corporate trustee where they are joint and severally liable.

This certainly seems excessive in the context of the fund’s due date for lodgement of the SMSF Annual Return still 45 days away. Even more so, when you consider that an auditor is required under to provide an audit report to the trustees within 28 days of having received all relevant to undertake the audit.

To look to apply administrative penalties in such a scenario when the Commissioner can already impose ‘failure to lodge’ (FTL) penalties seems extreme.

Subject to the outcomes of the consultation period, these measures would apply the day after the Regulations are registered.

Consultation remains open with Treasury until 17 November 2020. More information on these amendments are under consultations on the Treasury website.

Let’s hope some common prevails, as I’m not sure there’s anyone in the industry who would favour this position.