With financial markets having gone into free fall since the end of January, this has not only had a significant impact on the super balances of fund members, but has also heightened a range of compliance issues across the SMSF industry. This includes the potential impact on in-house asset (IHA) arrangements, which was flagged with the ATO to consider the how to respond in this uncertain economic environment.

Investment restrictions apply where an SMSF places an amount of its assets in investments, loans or leases with related parties of the fund. These in-house assets must not generally exceed 5% of the market value of its total assets, unless any of the allowable exceptions apply.

An in-house asset is any of the following:

- a loan to, or an investment in, a related party of the fund

- an investment in a related trust of the fund

- an asset of the fund that is leased to a related party.

For a fund to ensure that it stays within the 5% threshold it needs to be aware of how changes in financial markets may impact this calculation, in particular in light of the current corrections we have seen globally.

Following discussions between key stakeholder and the Regulator last Friday, the ATO has been quick to respond to IHA arrangements that may be adversely affected by this significant change in market value.

Below is the extract from the ATO’s COVID-19 page on this IHA issue:

ATO Q&A – IHA restrictions

Question: The downturn in the share market may result in the fund’s in-house assets being more than 5% of the fund’s total assets. The in-house asset rules would be breached. What do I need to do?

Answer: If, at the end of a financial year, the level of in-house assets of a SMSF exceeds 5% of a fund’s total assets, the trustees must prepare a written plan to reduce the market ratio of in-house assets to 5% or below. This plan must be prepared before the end of the next following year of income. If an SMSF exceeds the 5% in-house asset threshold as at 30 June 2020, a plan must be prepared and implemented on or before 30 June 2021. However, we will not undertake compliance activity if the rectification plan was unable to be executed because the market has not recovered or it was unnecessary to implement the plan as the market had recovered.

Creating a written plan

If the market value ratio of the fund’s in-house assets exceed the 5% threshold at 30 June 2020, it must follow the legislative requirements within section 82 of the SIS Act which requires the trustees to prepare a written plan.

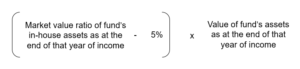

In the plan, the trustee is required to specify the amount worked out using the following formula:

Within the plan, the trustee must set out the steps which the trustee proposes to take in order to ensure that:

- One or more of the fund’s IHAs held at the end of that year of income are disposed of during the next following year of income; and

- The value of the assets so disposed of is equal to or more than the excess amount.

The concession being provided here by the ATO to trustees applies in one of two ways:

- Where the trustee implements a written plan, but is unable to execute the plan before 30 June 2021 as a result of financial markets not recovering, then the Regulator will not apply compliance resources to this unintended breach; or

- Where the trustee implements a written plan, but ultimately sees financial markets recover, the trustee will not be responsible for having to execute on the plan as the fund would no longer be in breach of the 5% IHA threshold.

For further information about how the ATO is responding to a variety of superannuation please refer to the ATO’s COVID-19 webpage.